Most traders make decisions based on intuition or incomplete information, leading to inconsistent results. Comprehensive backtesting changes this by providing objective data on how strategies would have performed over extensive historical periods.

-

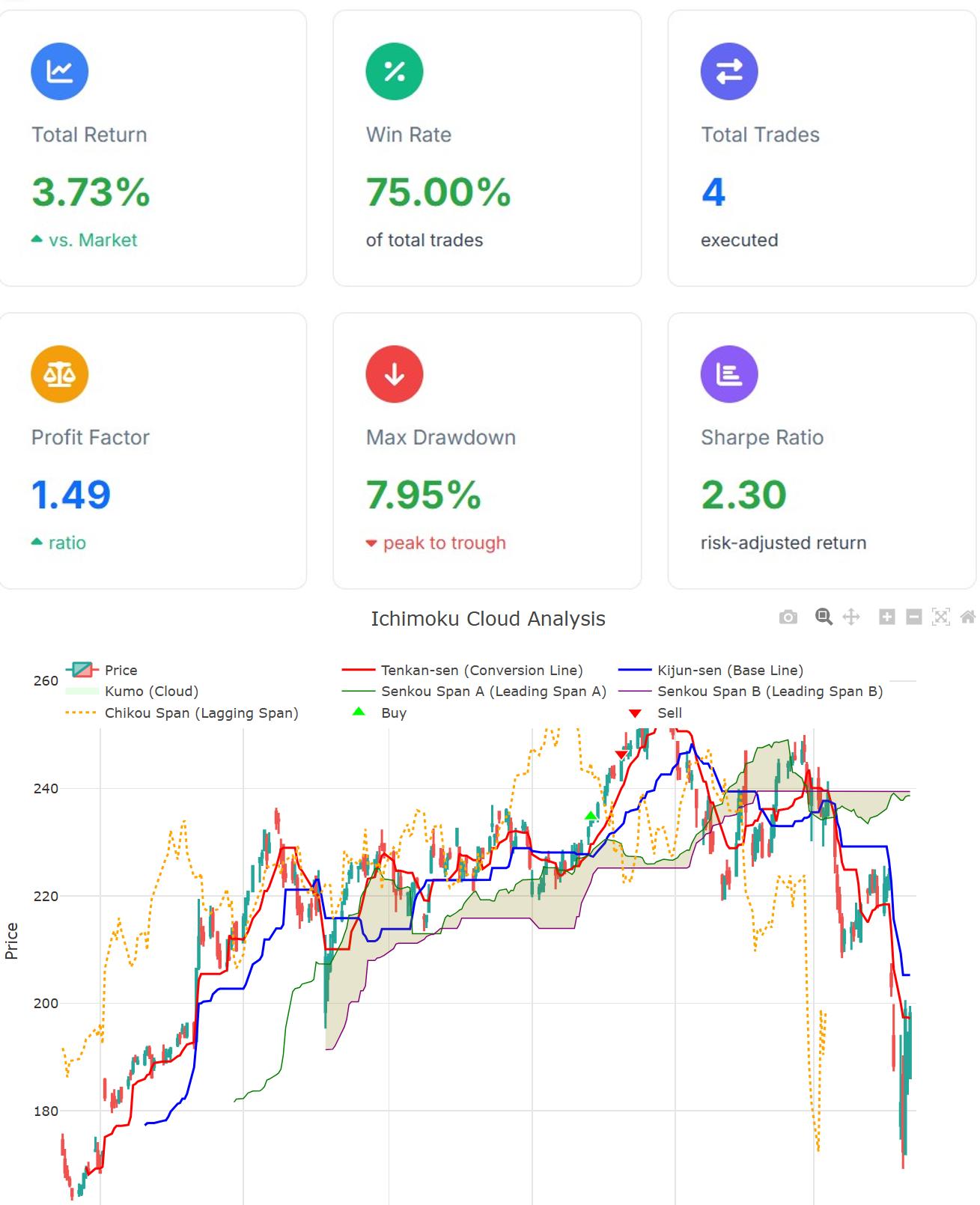

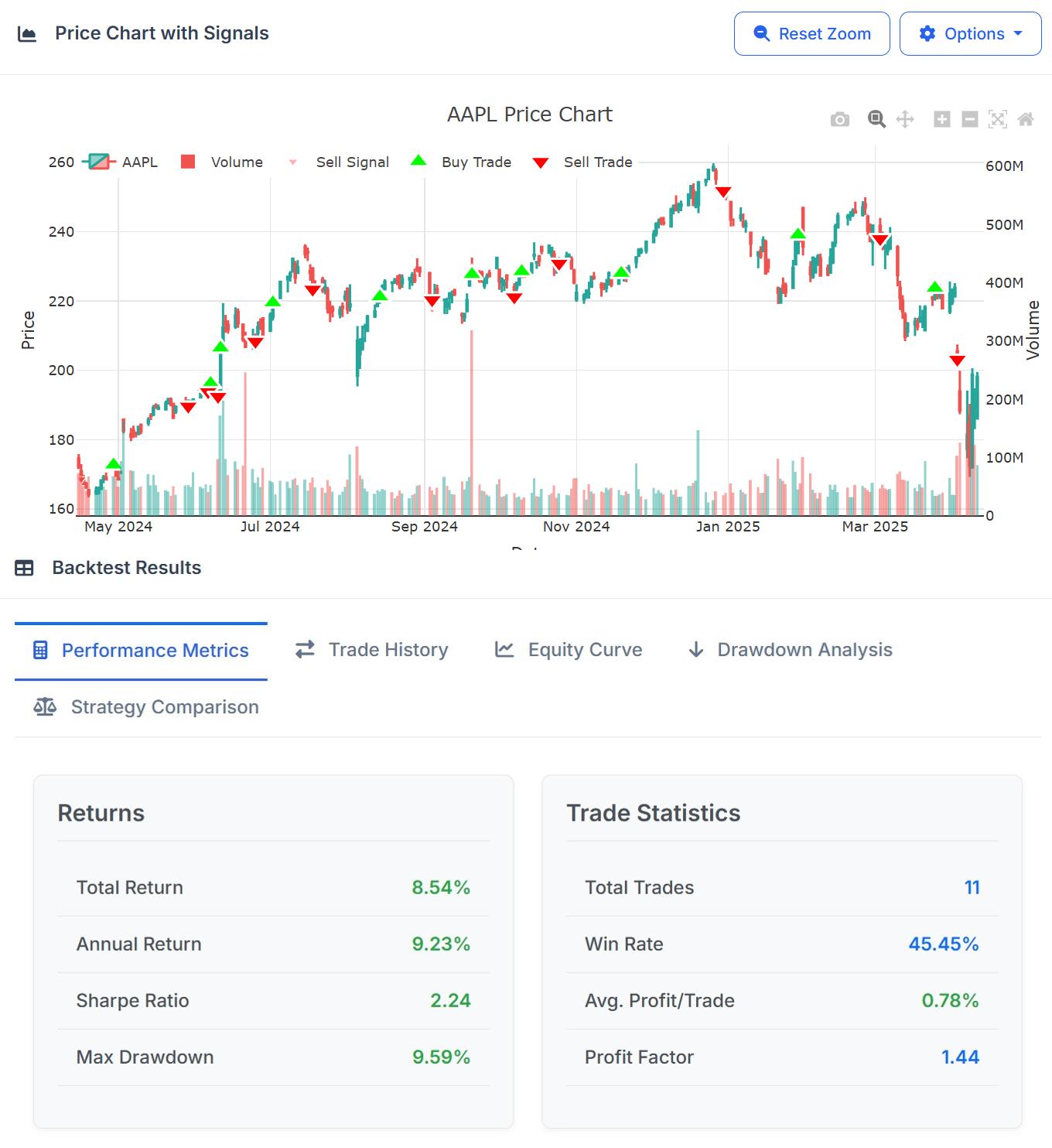

Validate Trading Strategies

Test your trading ideas against real historical market data to see what actually works before risking real capital.

-

Eliminate Emotional Bias

Remove the emotional component from trading decisions by relying on objective performance metrics rather than intuition.

-

Understand Risk Profiles

Identify maximum drawdowns, volatility patterns, and worst-case scenarios to properly size positions and manage risk.

-

Build Trading Confidence

Develop the confidence to stick with proven strategies during tough market periods by knowing their historical performance.